Canada’s inflation rate Falls Below Expectations To 2.7% Rather Than Expected 2.8%

Canada’s Inflation Rate Falls Below Expectations to 2.7%

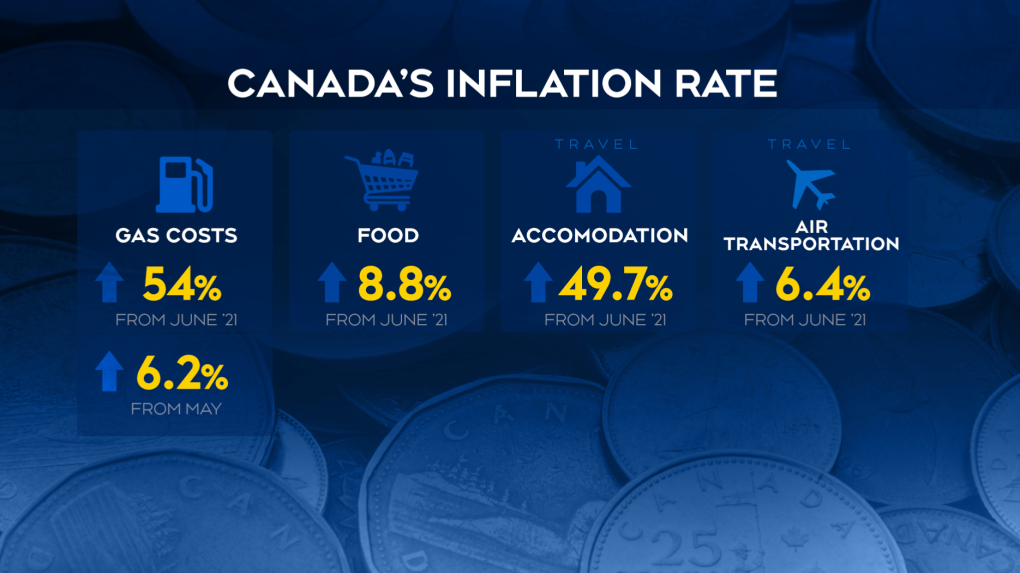

In a surprising turn of events, Canada’s annual inflation rate cooled to 2.7% in June 2024, slightly below the expected 2.8%. This decline marks a significant moment for the Canadian economy, as it navigates through a period of economic uncertainty and fluctuating prices.

Understanding the Numbers

The 2.7% inflation rate is a notable decrease from previous months, where inflation had been persistently high. Analysts had predicted a 2.8% rate, but the actual figure came in lower, providing a glimmer of hope for consumers and policymakers alike. The primary driver behind this cooling was softer growth in gas prices, which have been a significant contributor to inflationary pressures over the past year.

Core Inflation Insights

Core inflation, which excludes volatile items such as food and energy, also showed a marginal decrease. This measure is closely watched by the Bank of Canada as it provides a clearer picture of underlying price pressures. Despite the overall cooling, core inflation remains sticky, indicating that some price pressures are still present in the economy.

Impact on the Bank of Canada

The lower-than-expected inflation rate gives the Bank of Canada some leeway in its monetary policy decisions. With inflation showing signs of cooling, there is increased speculation that the Bank may consider cutting interest rates in its upcoming meeting. Traders have already increased their bets on a rate cut, anticipating that the central bank will take action to support economic growth.

Grocery Prices on the Rise

While the overall inflation rate has cooled, grocery prices have started to heat up again. This renewed pressure on food prices is a concern for many Canadians, as it directly impacts their daily living expenses. The rise in grocery prices highlights the uneven nature of inflation, where some sectors experience relief while others continue to face upward price pressures.

Economic Outlook

The cooling inflation rate is a positive sign for the Canadian economy, but challenges remain. The Bank of Canada will need to carefully balance its approach to ensure that inflation continues to trend downward without stifling economic growth. The upcoming interest rate decision will be closely watched, as it will provide further insights into the central bank’s strategy for managing inflation and supporting the economy.

Consumer Impact

For Canadian consumers, the lower inflation rate may bring some relief, particularly in areas like fuel costs. However, the rise in grocery prices means that many households will still feel the pressure.

Government and Policy Response

The Canadian government has been actively monitoring the inflation situation and implementing measures to mitigate its impact. This includes targeted financial support for vulnerable populations and efforts to stabilize key sectors of the economy. The Bank of Canada’s monetary policy, including interest rate adjustments, plays a crucial role in managing inflation and ensuring economic stability.